Managing an Endowment in a Post-COVID World

— Perspectives as of June 2020 —

This article is inspired by the 2020 ABACC webinar, “Managing an Endowment in a Post-COVID World,” presented in cooperation with John Regan and Connor Carew from

Permanens Capital Partners.

• • •

The post-COVID world looks much different than the world we knew at the beginning of 2020. We’ve seen both a historic sell-off and then a rally in capital markets. What are the long-term implications of this unprecedented event?

What Happened?

The market went down very quickly and then bounced back very quickly. We like to say the market is like a car with different dials and gauges. Even when you’re going 100 miles an hour, your check engine light might be on.

Challenging Market Environment

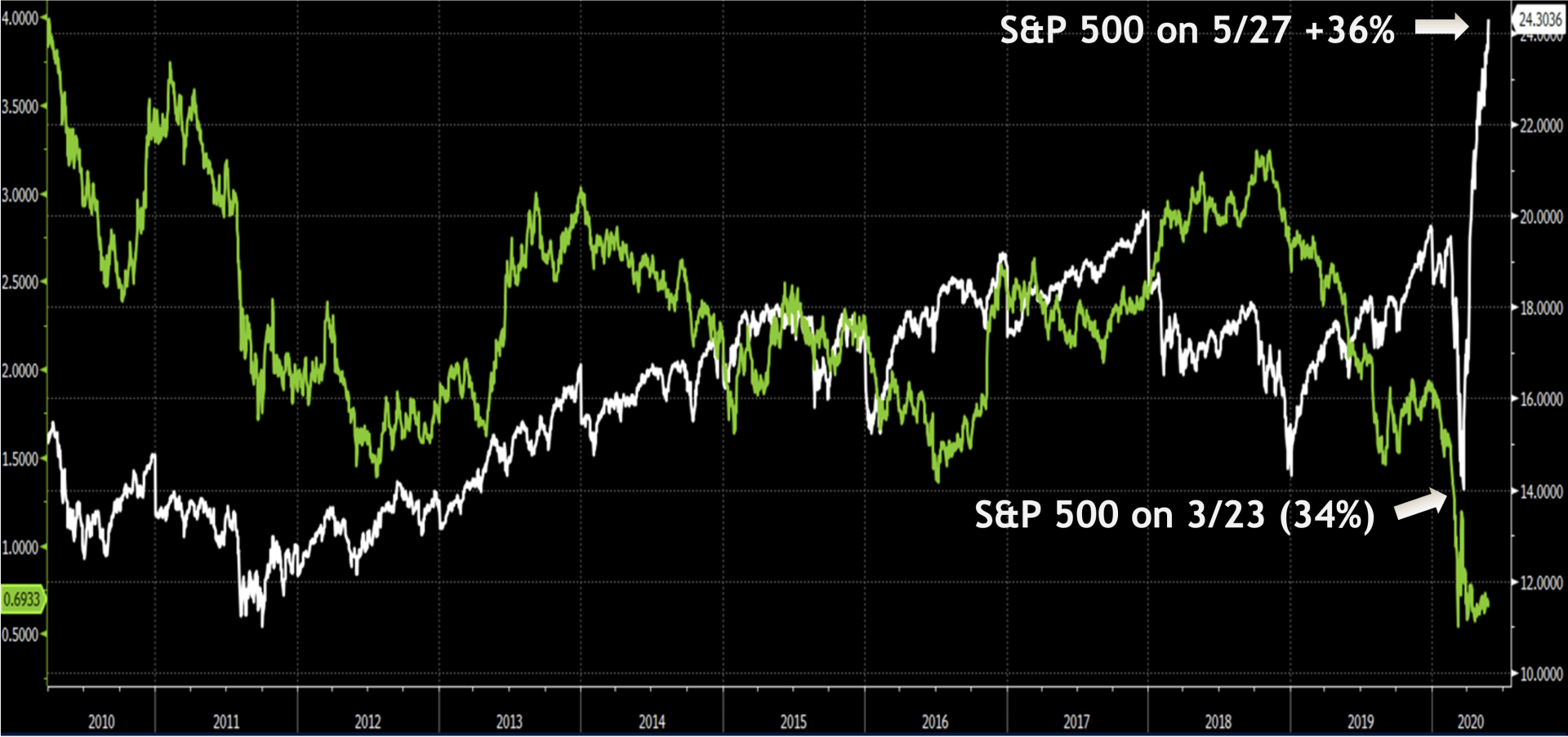

Higher Valuations & Negative Interest Rates

- Green Line: 10-Year Treasury yield, now at historic low of 0.7% yield

- White Line: Valuation (P/E) of S&P 500, approaching 20-year high

Source: Bloomberg

What does this mean? Equities are extremely expensive right now and real rates are negative. So, if you thought meeting your endowment draw was tough before COVID-19, it just got much harder.

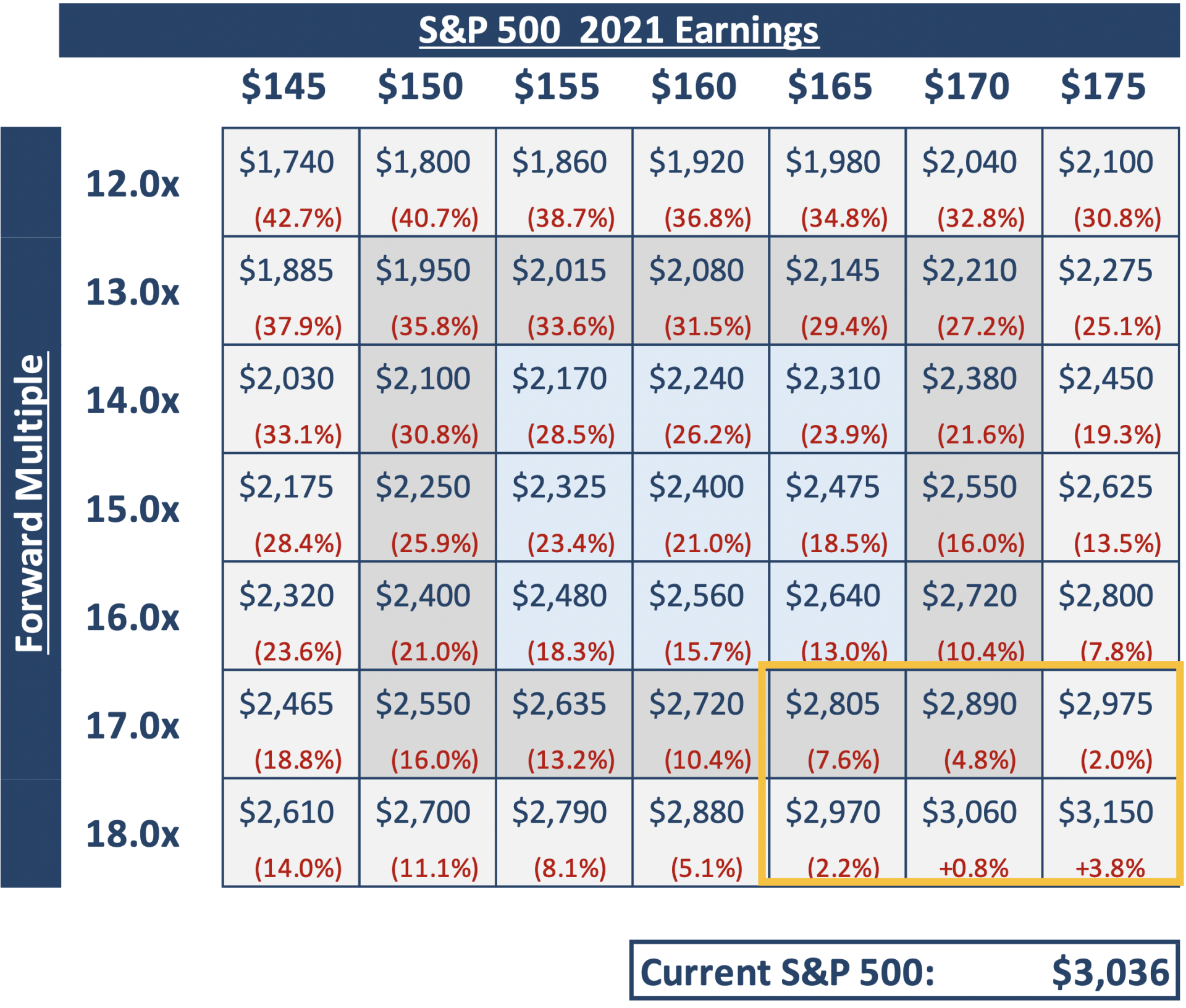

The Bulls Versus Bears Market Perspective: Is the Equity Market Overvalued or Fairly Priced?

The bulls expect a V-shaped recovery and make the case that the equity market run is justified. The bulls have conceded the 2020 decline in earnings and believe there is going to be material recovery in 2021.

Multiple on 2021 Earnings

S&P 500 Pricing in Full Recovery by 2021

- Consensus earnings of ~$170 at a 17x-18x multiple puts S&P 500 level in range

- Real rates being negative justifies higher multiple

Source: Bloomberg

With 2021 earnings estimated to be around $172 a share and a reasonable premium of 17 to 18 times that, you get to roughly 3000 for the index, which is exactly where the market is trading today. Markets are looking at this year as a blip and are pricing a 2021 recovery.

Information Technology Holding Up Market

Market Benefitting from Concentration

In the past two recessions, market concentration has led declines. But in 2020, market concentration actually buoyed the rest of the market.

Source: Goldman Sachs

In 2001, tech led to the decline. In 2008, financials led to the decline. But in 2020, information tech has actually fared well, given it was a source of interest during the global shutdown.

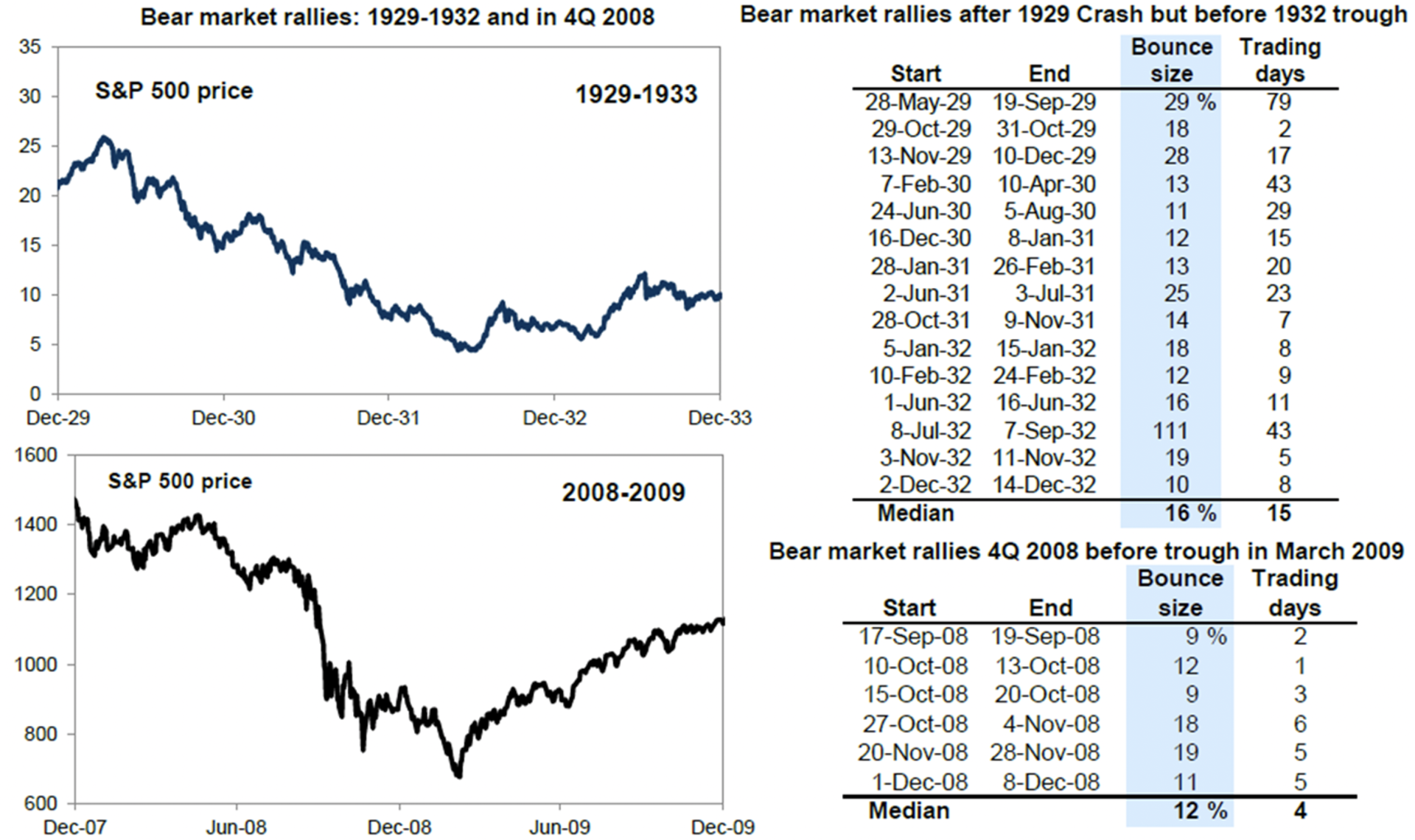

S&P 500 Bear Market Rallies

Another argument the bulls are making has to do with bear market rallies. Take a look at two large economic collapse periods in U.S. history, 1929 and 2008.

Source: Goldman Sachs

Outside of July 1932, we have not had a bear market rally exceed 29%. We’re already up about 44%. This contends that we have exited bear market territory and we’ve actually entered into the next bull market.

The Bears Market Perspective: Is the Equity Market Overvalued or Fairly Priced?

The bears believe we are in a slower economic recovery and there are elements to this economy that will take quite some time to sort out.

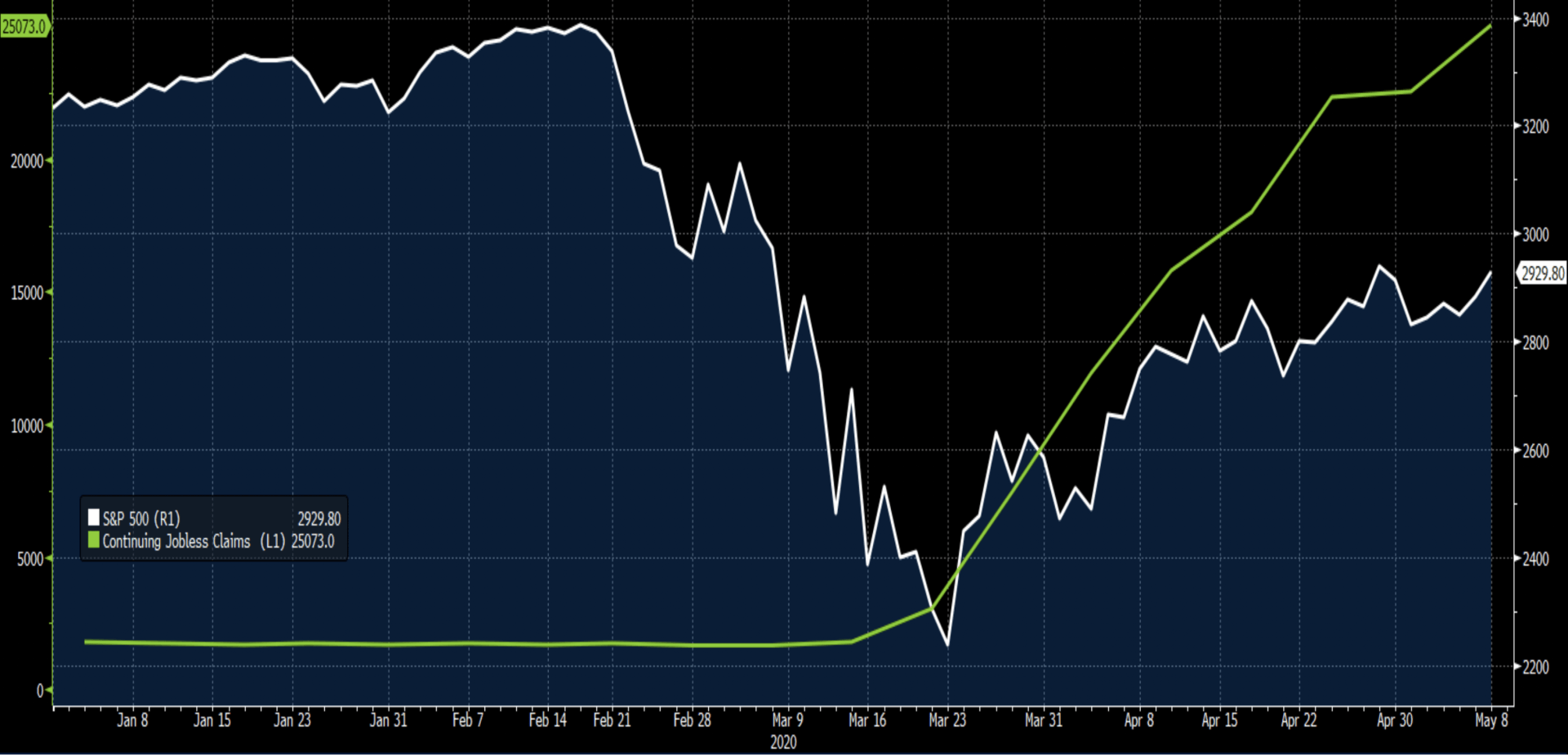

Current U.S. Unemployment at All-Time Highs

The first argument the bears are making is that the market is disconnected from the economy. Unemployment is hitting historic highs. In a 10-week period through the end of May there were 40.7 million initial jobless claims filed, although it’s too early to decipher between temporary versus permanent job loss.

S&P 500 and Continuing Jobless Claims (Unemployment)

Market Pricing in a Quick Labor Recovery

- White Line: S&P 500 continues to rise despite increased jobless claims

- Green Line: Jobless claims increasing at an unprecedented rate

Source: Bloomberg

This graph illustrates something quite abnormal. Interestingly, jobless claims start to rise and the S&P 500 rises with it. This doesn’t make sense in the view of the bears.

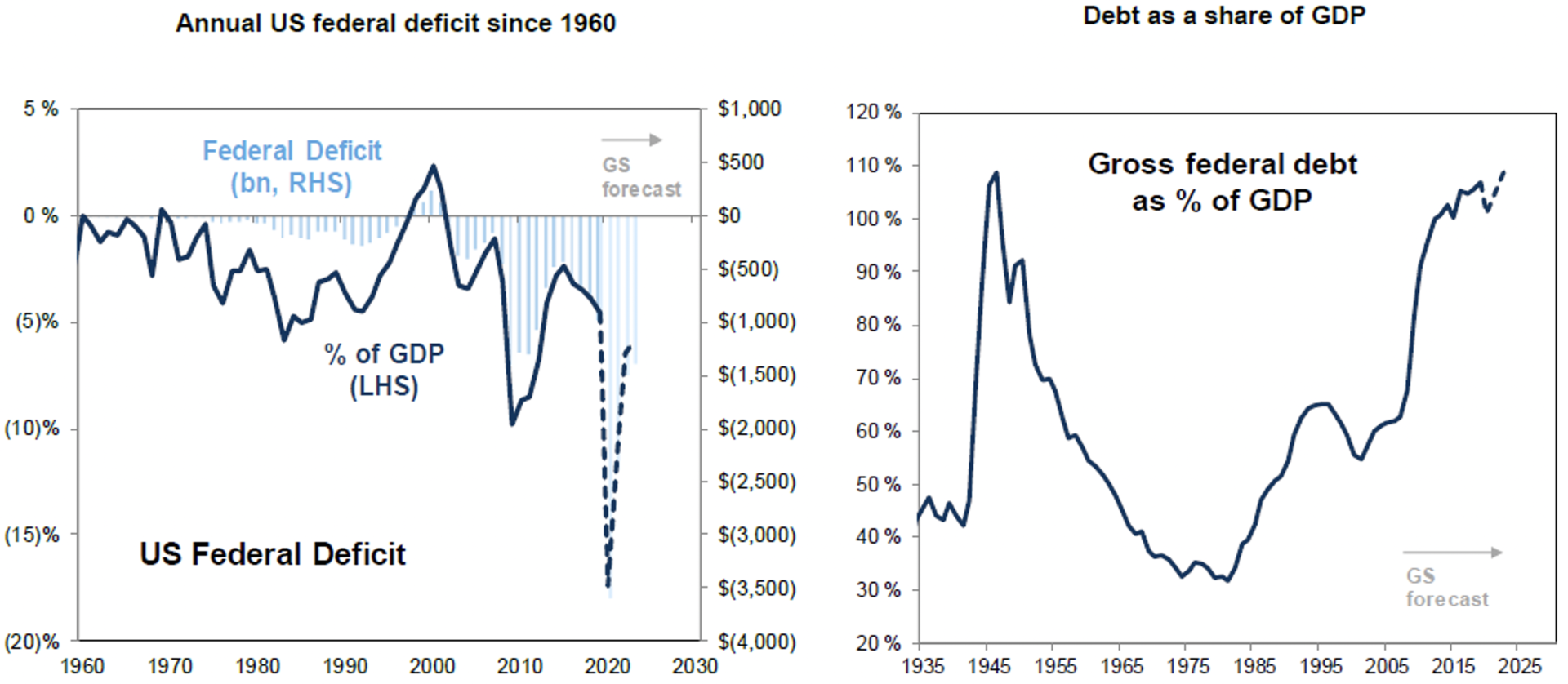

Federal Debt = Market Steroids

107% Federal Debt/GDP Ratio is Highest Since WWII

The federal debt as a percentage of GDP is about to blow through the last high, which was in 1945, post-World War II. The double whammy is the federal debt is rising while GDP is declining.

Source: CBO, Goldman Sachs

Also, this doesn’t take into account the Federal Reserve’s balance sheet, which is at a record level following the economic stimulus package from earlier in 2020.

Gold Reached an 8-Year High

Volatility and Inflation Fears Driving Demand

Unprecedented stimulus from the Fed and U.S. government has ballooned the U.S. balance sheet, stoking inflation fear and driving demand for gold. Gold moving in tandem with the stock market is not normally the case.

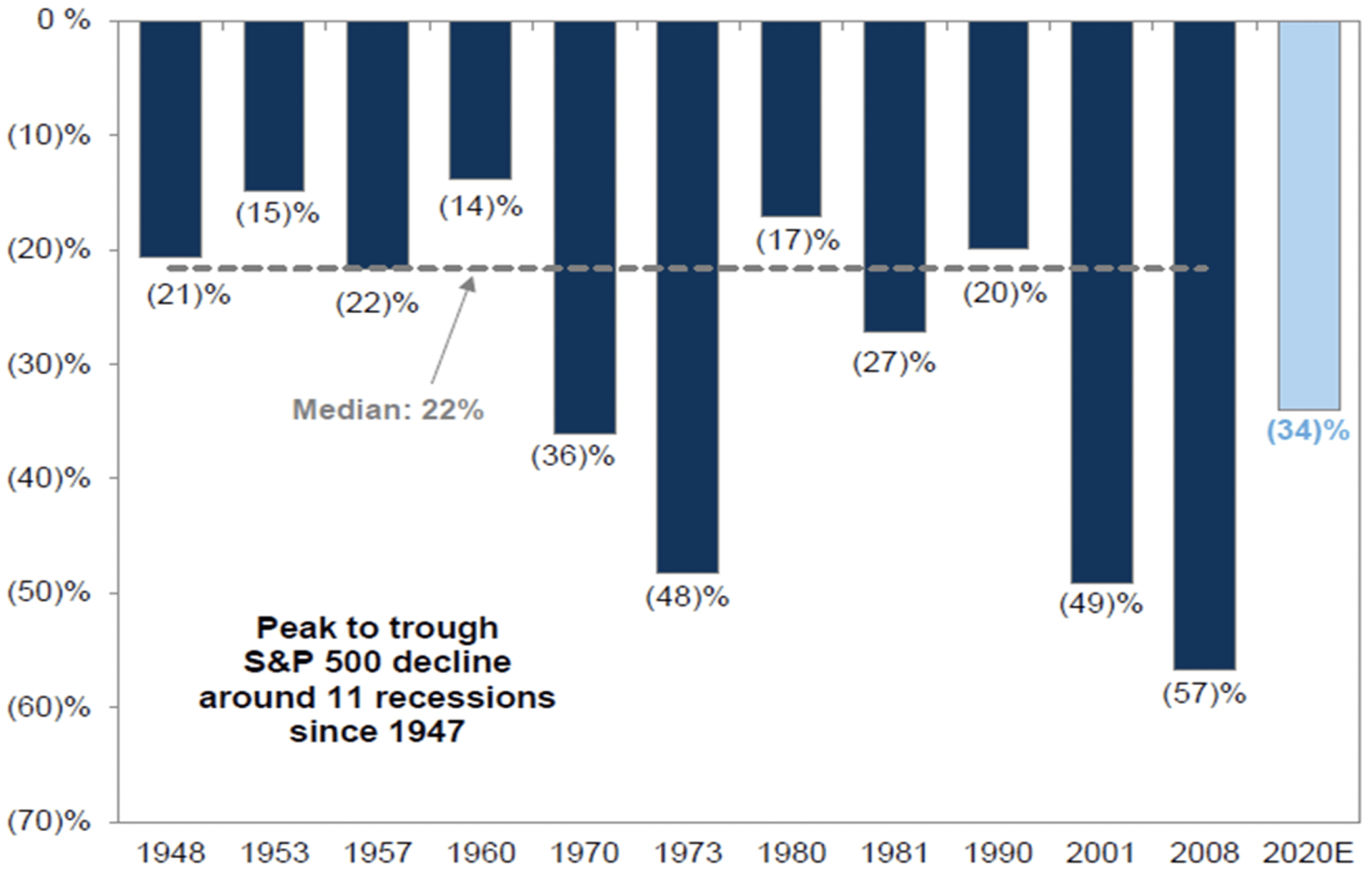

S&P 500 Index Declines During Recessions

Median S&P 500 Decline is (22%)

- S&P 500 has experienced an average (20%) decline during the past 11 recessions

- Including 2020, the five most recent recessions declined (37%) on average

Source: Goldman Sachs

It’s important to remember over the last two notable recessions, 2001 and 2008, we experienced 50% and 57% declines in the stock market. From February 2019 to March 2020 we saw a decline of 34% from peak to trough.

Is this time different? What will be the economic impact of the world being shut down? Those are the question the bears are asking.

Summary: Bulls Versus Bears

To recap, the bulls are saying this year doesn’t matter and we’ll see a material recovery quite quickly. But the bears believe there is impairment to the economy, which will affect equities for a longer period of time.

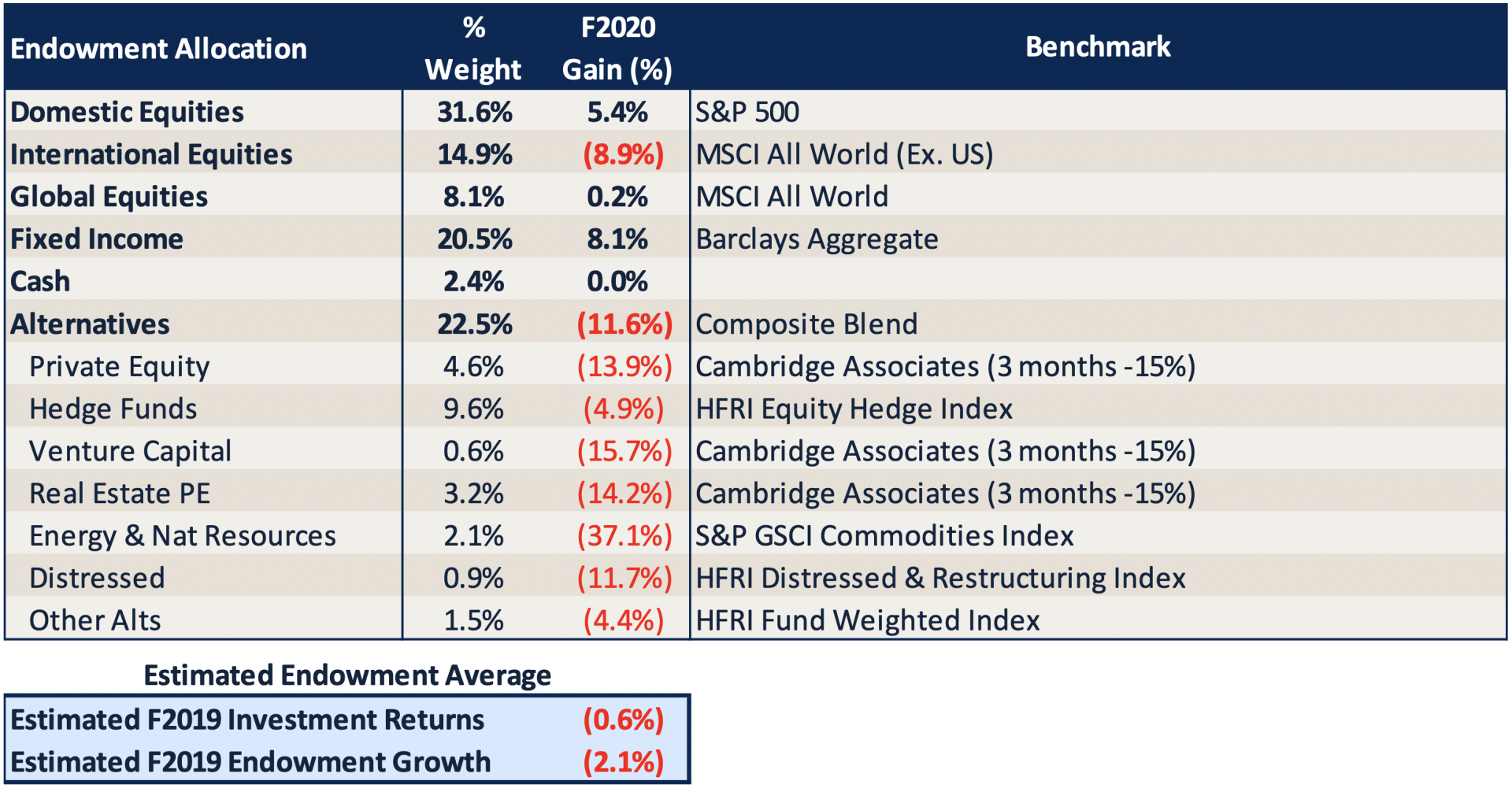

Projected Endowment Performance (estimate as of 5/31/20)

We estimate that for fiscal 2020, most endowments are down around 1%.

- There will be significant write-downs in private equity.

- Hedge Fund allocations insulated portfolios, declining half that of global equities.

- Long-duration treasuries and agencies outperformed, while credit suffered greatly.

- U.S. equities outperformed rest of world equities.

Upcoming Investment Committee Conversations

These are some topics to bring back to your next IC meeting:

Asset Allocation & IPS

- Asset allocation changes

- Risk tolerance adjustment

- Review draw policy & school finances

Performance

- Asset class versus benchmark

- Manager analysis

- Liquidity issues

Communication

- Reporting remain consistent

- Advisor business continuity

Given this environment was so unprecedented, first you should evaluate your risk. Not every school has the same goals, wants, and needs. If you were left feeling uncomfortable with the volatility you had to stomach, it’s a good time to start that conversation.

Next, it’s a good time to review the underlying portfolio performance, by looking at manager returns, asset class returns, and the liquidity profile of your hedge funds.

Finally, if you haven’t done so already, check in on your asset management firm’s business continuity, to make sure that you feel comfortable with the operations of your current manager. How well are they communicating with you? Has reporting held up? How are they trading? How are they working with their third-party vendors?

Q&A: Greatest Concerns or Areas of Uncertainty

Will the U.S. market recover?

We’ve seen, if you go back to the beginning of the slide, the S&P 500 recover about 44%. The U.S. stock market is telling you that as well. Global stocks have seen a somewhat similar recovery, but they’ve lagged. The U.S. bond market has come ripping back, in terms of the credit move that we’ve seen in high-yield, investment-grade and leveraged loans. But the economics of the world are much different. Unemployment is at the heart. There is a percentage of our population that still has to skip a meal in order to save money. Starbucks is closing 400 stores. So, there’s risk of permanent impairment to the job market. Inflation is still historically low. You can’t get much of a yield on your bonds. Gold is flashing a warning sign. Oil is below $50 a barrel.

Are we entering a bull or bear market?

While many would argue we’ve entered a new bull market, there is a possibility this could be an outlier relative to other historical bear market rallies, and we could see another leg down. The word of advice we’ve been given our clients is having a little bit of cash and being cognizant of the high valuation in equities is not only appropriate, I would argue it’s prudent.

What if there’s a second wave of COVID-19?

We’ll see a negative reaction from the stock markets for sure, because the markets have learned that global policymakers haven’t been the most efficient or the best at communicating how to handle the first wave. The markets do not like uncertainty. I would like to think we will handle a second wave a little differently, in terms of what we shut down and why. Ultimately, I don’t think the world could take another three-month period without economic movement. Things could start to grind and maybe break. We saw flashes of that when people were not able to sell their treasuries. But the Fed stepped in and did a monumental thing which kept markets moving. A second wave would definitely be a cause for concern.

How can I best develop or modify our asset allocation to mitigate unprecedented market movement in the future?

A great way to think through this is understanding your long-term goals as an institution. If you have a long-term investment portfolio with a horizon of 10 years, these movements don’t feel great, but ultimately you should see your asset classes recover. If you’re a small or mid-size institution with assets earmarked for certain projects or initiatives, then you may want to consider allocating assets with capital preservation in mind—more high-grade fixed income—depending on what your plans are.

How will the pandemic impact long-term unemployment?

The natural thought is that if more people are at work, it’s less stimulating for the economy. Right now, the stock market is behaving as if everyone is going to get their job back. If we follow that trend, hopefully people feel a little bit more comfortable. But the real concern is, will companies start to realize that there are more ways to use technology to outsource jobs, which would be a bigger impairment on the economy.

What about investing endowments in China?

China is very unpredictable. The pandemic appears to have originated there and another trade war is about to ensue. We have chosen to be heavily underweight in China for our clients. Investing in China is quite difficult—there’s not a lot of transparency and you have to get the currency right. These are valid concerns to bring up with your investment manager.

How has this environment affected energy future valuations?

I’m not an energy analyst, but one headwind for oil is the ESG movement. There’s a lot of divestiture happening across the energy space, which will have a negative impact on that sector.

Has this environment made active equity managers more important or valuable?

Yes. The dispersion between stocks has grown and volatility has increased. When these factors are present, active management does outperform passive. Passive management has done quite well versus active management over the last 10 years of the bull market. But there is definitely an opportunity now for active to outperform passive, as we’re starting to see a greater disconnect between stocks and the index.

Ask a School Insurance Underwriting Expert: As Winter Approaches, How Can We Protect Our Facilities?

Association of Business Administrators

of Christian Colleges

4578 Hidden Ridge Drive

Hudsonville, MI 49426

(877) 303-8666

Empowering Christian Business Officers

Fulfill your calling, solve challenges, and maximize resources to accomplish the mission of Christian higher education.