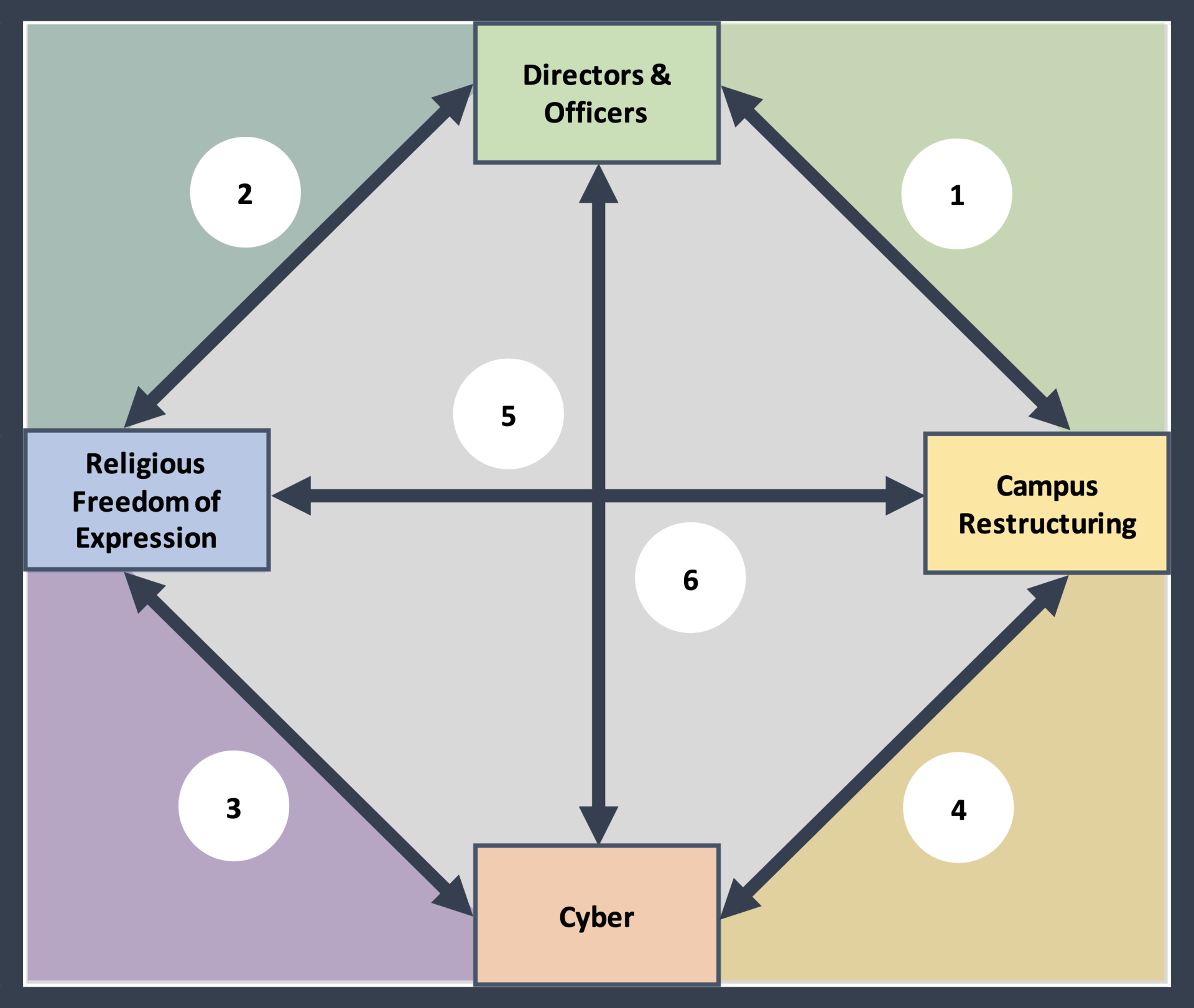

Shining a Light on Postsecondary Blind Spots: 6 Key Interdependencies

The education policy landscape for commercial insurance has changed dramatically over the past decade. Business administrators need to be informed and equipped to identify “red flags” in commercial insurance policy language in order to proactively address potentially costly institutional blind spots within their coverages. In order to shine a light on potential blind spots, it is important to identify and investigate nebulous, emerging, and overlooked risks as these can lead to significant and costly claims. The following four topics are ripe for consideration: Protecting Your Board of Directors, Religious Freedom of Expression, Campus Restructuring, and Cyber Liability. Each exposure warrants risk consideration from a static viewpoint, but these topics can also have dangerous interdependencies, allowing for dynamic institutional losses.

This article provides a summary of key points from a recent ABACC webinar, wherein these four topics and their interdependencies are discussed from a risk perspective, as shown in the diagram below:

Key Points

Protecting Your Board of Directors

- Directors & Officers (D&O) coverage protects the personal assets of your leadership.

- The quality of a D&O policy is in the details. Coverage starts from a very broad position and is scaled back through definitions (“application” and “insured”), warranty statements, exclusions, and coverage period.

- Be careful of eroding the D&O limits through blended policies (D&O and EPLI combined) as well as defense costs offered within the limits.

- Always make sure that coverage is truly continuous. Pay specific attention to the Continuity, Prior & Pending Litigation, and Retro Dates.

- Many coverage restrictions are available for buy back. The larger the D&O policy is, the more flexibility and purchasing power you have.

- Review, review, review. D&O insurance is complex and highly technical. It is not your job to be the expert. Your broker is your best advocate, so use their expertise.

Protecting Your Religious Freedoms

- Consistency is key: proactive and defensive strategies are available to protect sincerely held religious beliefs.

- On the proactive side, institutional beliefs need to be sincerely held and demonstrated. Those beliefs need to be clearly articulated in vision, mission, and purpose statements, institutional bylaws, and reinforced in departmental policy language.

- On the defensive side, claims made by third parties that arise from mental anguish and/or emotional distress may be covered under general liability and excess policies’ coverage limits dependent upon policy language definitions and exclusions, the impact rule, and state legal precedent.

- Freedom of Expression Legal Expense Reimbursement (FELER) can provide reimbursement payments up to a predefined sublimit for out-of-pocket religious defense costs.

- Beware inter/intra-denominational exclusions within the policy language.

Campus Restructuring

- Prior to campus restructuring, verify that the risk management process has been integrated into the strategic planning, organization, and execution, and that you have selected the most appropriate approaches to financing, transferring, and controlling identified risks.

- Anytime there is a change in operations, this can open the institution up to new exposures. Proactively evaluate the risks and identify blind spots that are tangibly associated with the changes.

Cyber Liability Insurance

- Cyber liability is one line of insurance coverage specific to first- and third-party:

a. bodily injury or property damage,

b. personal and advertising injury,

c. intellectual property, or

d. errors and omissions. - Cyber liability coverage is carve-out coverage, born out of necessity due to increasingly restrictive exclusions implemented within General Liability policy language for electronic data.

- As policy exclusions eliminate questions surrounding “silent cyber”, it is reasonable to expect more carve-out, stand-alone policies for cyber coverage beyond Liability. Some examples might include cyber coverage for Property, Directors & Officers, and Commercial Auto lines.

- Cyber policies are highly technical and warrant review of the following areas: “Authorized Use”, “Covered Events”, and “Cause of Loss.” It is also important to note first- and third-party coverages and exclusions as these can vary greatly across carriers due to lack of policy and coverage standardization.

- Costs are changing in response to the prevalence of claims. Coverage is likely to continue to increase in cost in response to increased claim frequency and severity.

- Carriers are reliant on the warranty/surety statements provided about systems, networks, and data. Be sure to have IT specialist complete technical sections of these applications, as even innocent misstatements can be viewed as violations of warranty wherein payment is denied in the event of a claim.

Key Interdependencies

1. Directors & Officers and Campus Restructuring

Anytime there are large financial investments, changes, or new projects, your board of directors opens themselves up to additional exposures. Building campaigns, campus restructuring to a virtual environment, and changes in operations are all “red flags” that should trigger in your mind “D&O exposure.”

2. Directors & Officers and Religious Freedom of Expression/FELER

Claims arising out of Free Speech and Free Expression will inevitably involve institutional leadership, including the directors and officers. The legal process can drag out for years for certain claims, with potential for financial, institutional, personal, and reputational damages. Be especially aware of inter- and intra-denominational exclusions in D&O policy language that would absolve a carrier from duty to defend.

3. Religious Freedom of Expression and Cyber

Always be certain to obtain robust electronic media liability limits within an institutional cyber policy. Electronic media liability insurance covers claims concerning libel, slander, defamation, etc., arising from/in response to electronic data—e.g., internet publications, social media, and blog posts.

4. Cyber and Campus Restructuring

Consideration is warranted for increased privacy security concerns, network security, and cyber security continuity. Virtual exposures extend even to logo design, social media, and blog posts. Other exposures may not be as apparent, such as going through a new building project. With new construction you are interacting with new vendors and contractors. Since cyber is excluded under general liability, anytime there is a campus restructuring it is important to consider those institutional exposures related to information and data.

5. Religious Freedom of Expression and Campus Restructuring

Recall that states treat “emotional distress” and “mental anguish” definitions differently. The same Free Speech/Free Expression claim brought against an institution, considering campus expansion or geographic footprint—whether physical, virtual, or through articulation agreements/use of extension campuses—may produce different results dependent on that state’s interpretation of the impact rule and legal precedent.

6. Cyber and Directors & Officers

To reiterate the points above, anytime there is a significant change, the D&O exposures increase. Consider factors such as the decision to move to a virtual learning environment and the subsequent cyber implications. Has the board of directors done their due diligence to implement systems through a security-by-design framework? Further, consider looking into common D&O exclusions pertaining to cyber and foreign operations. Most policies will exclude D&O coverage stemming from cyber related incidents.

About this Article and Author: “Shining a Light on Postsecondary Blind Spots” is the second of a four-part ABACC webinar/article series dedicated to assisting HR and Finance officers of Christian Postsecondary Institutions navigate the nuances and complexities of commercial insurance. As Christian Risk Advisors, the intended purpose of each webinar is, simply put, to equip the saints. Each installment’s aim is to provide a contextual framework, descriptive detail, and some helpful takeaways, for a digestible glimpse of insurance and risk management processes from multiple angles. In response, financial decision-makers of Christian institutions will be able to take a more proactive and involved approach to insurance decision-making, grounded in understanding and accountability. General or specific questions about topics within this article, the webinar series, or commercial insurance renewals can be directed to Eric Price or by clicking on the Atlas Insurance Agency banner ad within this article. We look forward to continuing to serve ABACC’s member institutions, and God bless.

Eric Price, CSRM, MPP

Christian Risk Advisor

Michael Howard, CRM, CIC, CWCS

Christian Risk Advisor

Ask a School Insurance Underwriting Expert: As Winter Approaches, How Can We Protect Our Facilities?

Association of Business Administrators

of Christian Colleges

4578 Hidden Ridge Drive

Hudsonville, MI 49426

(877) 303-8666

Empowering Christian Business Officers

Fulfill your calling, solve challenges, and maximize resources to accomplish the mission of Christian higher education.